Part 1: Opportunity Sourcing and Assessment

The U.S. invests more than $120 billion in federally sponsored research funding at universities and national labs. Technology Transfer Offices (TTOs) are unique entities within these largely non-profit organizations that serve the purpose of out-licensing inventions to companies for commercialization. The number of issued patents, startups, commercialized products, and consequently, the societal and commercial impact of technologies developed in universities, have all been on the rise [1].

Sourcing the Technologies

New technologies available for license from universities and federal research labs across the US and around the world can be accessed through TTO websites and via third-party technology sourcing platforms (e.g., IN-PART) which list thousands of available technologies from numerous institutions. VIC has licensed technologies from research institutions throughout the US and internationally and has working relationships with a large number of them. Many of these TTOs regularly send us opportunities to review based on their understanding of VIC’s areas of interest and investment thesis. In each location where we have a physical presence, we make a particular effort to develop a working relationship with the top research institutions in that region.

The commercial potential of the technologies available for license varies widely. Due to the sheer number of technologies to choose from, there are significant challenges with screening and assessing the opportunities in order to find the ones that have the highest reward to risk ratio for commercialization. The technical and market evaluation of these inventions is an area that VIC has considerable expertise in.

Assessment Process

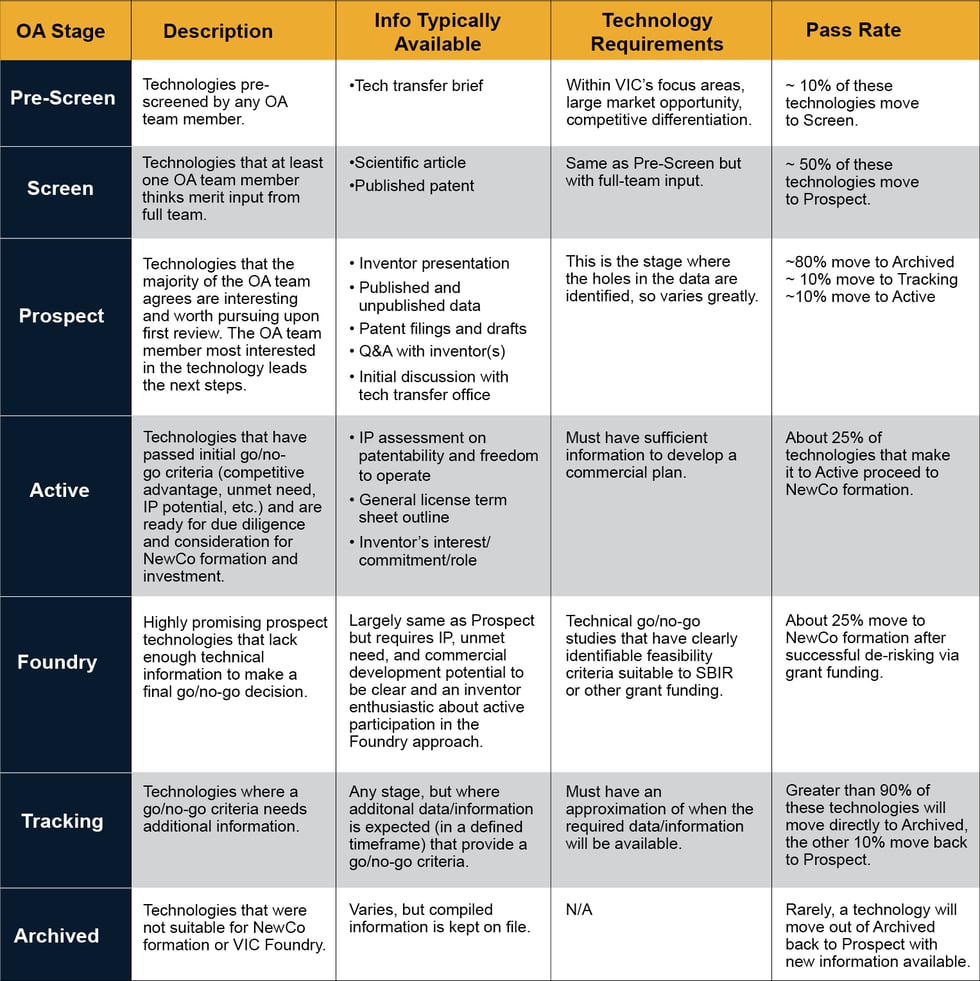

VIC has an opportunity assessment (OA) process that helps identify the most promising technologies that fit within VIC’s scope of interest (life science technologies including therapeutics, diagnostics, medical devices, and vaccines). VIC’s OA team comprises our Managing Directors, in-house scientists and engineers, our VIC Fellows, and our Strategic Advisory Board. Each week, the core OA team members review numerous life-science technologies (“Pre-Screen” stage in Figure 1 below) and only about 10% move to the “Screen” stage, based on the healthcare problem being addressed and the uniqueness of the solution. Each technology identified as being of possible interest in the Pre-Screen step is brought forward and discussed by the OA team for further evaluation of the materials provided by the research institution. About 50% of these technologies move forward into “Prospect” stage, when discussions with inventors and a deeper assessment of areas such as intellectual property landscape, market drivers, etc. are reviewed. A large majority of Prospect technologies get archived at this stage of the due diligence. Only a few of the most promising technologies either move to “Tracking”, where additional, longer-term information is still needed to make a go or no-go decision, or directly to “Active” stage. This is where technologies that present the highest commercial and global health impact opportunities proceed to full-scale due diligence. A select number of these “Active” technologies move forward to licensing into a new VIC portfolio company, with initial investment from our affiliated VIC Investor Network. Others may move to the VIC Foundry for further development and de-risking in collaboration with the inventors, using government grant funding (e.g., SBIR) and then, if that work is successful, move to new company formation.

Figure 1 Below: An overview of VIC’s opportunity assessment process for screening technologies available for license from universities and research laboratories as the potential intellectual property (IP) foundation for new ventures that VIC forms.

Areas Covered in Assessment

Key questions that are taken into consideration by VIC while evaluating technologies and their associated risks include the following:

-

- Is the technology solving a problem and fulfilling an unmet market need? How big is the market opportunity? What are the market adoption drivers?

- How strong is the IP (patentability, freedom to operate, fields of use)?

- What sets the technology apart from its competitors i.e., what is the competitive advantage?

- Is the inventor team willing to work with VIC for effective technology transfer and improvement?

- What is the current stage of development (technology readiness level)?

- Is sufficient information available to develop a commercialization plan?

- What is the regulatory path?

- Who are the potential strategic partners / acquirers of the company? What is the anticipated exit path e.g., M&A?

- What milestones need to be achieved, along with timelines and costs involved, before the company can make a successful exit for its investors?

VIC’s systematic and thorough process for screening and assessing technologies allows us to find technologies that offer the highest reward-to-risk ratio for commercialization. See also “Behind the Curtain: Opportunity Assessment at VIC” for additional insights into VIC’s process [2]. Next month, we will cover the licensing process, key terms, and important considerations to keep in mind, from both the licensor (e.g., university) and licensee (e.g., startup company) points of view.

References: