The honest truth? Deciding which early-stage technologies will be successful is really hard. This is even more the case when you add the challenges faced in a university setting. Although I’m currently on the investment side of the table, I have worked throughout my career to access and nurture innovation created by academic researchers. This includes both licensing these assets as an entrepreneur and supporting their development as the head of university technology commercialization programs. So, for lack of a better description, I’ve been on both the “buy” and “sell” sides of the table. Because of the former, I know how frustrating the process can be, and due to the latter, I can empathize with the complexities of the ivory tower.

Let me start with a brief glimpse of life in a university Technology Transfer Office (TTO). First and foremost, universities are very political entities, at least an order of magnitude more so than industry. A common misconception is that the private sector is a more hard-nosed environment. Administrations and tenured faculty have a great deal of leverage and can influence how resources are allocated to back a given asset, even if the technical and business rationale doesn’t validate the decision to do so. For example, let’s say that the Chair of a well-funded, high-visibility department walks into the TTO  and asks why you decided not to submit a patent application based on a previously submitted invention disclosure. You can tell them until you’re blue in the face that your assessment of the translatability of their idea doesn’t support spending limited patent funds on it, which isn’t always well-received. Not being satisfied with your cogent and accurate rationale, the Chair decides to take it up the food chain to your superior, or—better yet—your boss's boss. You are then quickly notified that you will be filing a patent application for the invention. Although this may seem to be hyperbole, I’ve seen it happen many times: The squeaky wheel usually gets greased. My point in sharing this one vignette is that TTOs benefit from external consensus, especially that of potential investors and partners who would ultimately be responsible for moving the asset out of the lab and along the path towards commercialization. Having the unbiased feedback of experts in your back pocket can go a long way towards taking emotion and pride out of the equation.

and asks why you decided not to submit a patent application based on a previously submitted invention disclosure. You can tell them until you’re blue in the face that your assessment of the translatability of their idea doesn’t support spending limited patent funds on it, which isn’t always well-received. Not being satisfied with your cogent and accurate rationale, the Chair decides to take it up the food chain to your superior, or—better yet—your boss's boss. You are then quickly notified that you will be filing a patent application for the invention. Although this may seem to be hyperbole, I’ve seen it happen many times: The squeaky wheel usually gets greased. My point in sharing this one vignette is that TTOs benefit from external consensus, especially that of potential investors and partners who would ultimately be responsible for moving the asset out of the lab and along the path towards commercialization. Having the unbiased feedback of experts in your back pocket can go a long way towards taking emotion and pride out of the equation.

Luckily, many TTOs have begun to assemble groups of stakeholders to evaluate technologies and help prioritize which ones receive the right type and amount of resources. Case in point: UCSF’s Innovation Ventures recently formed a new division called Engagement and Opportunity Development (EOD) to provide guidance to researchers on questions of patentability, structure, market access, team creation and other concepts. To support the EOD team, they have developed an Entrepreneur in Residence (EIR) platform that enables industry experts and entrepreneurs to engage with and help advance these opportunities. VIC is actively involved in supporting this effort.

Another encouraging trend is the creation of university and/or state-focused funding mechanisms (non-dilutive, dilutive or hybrid) to move high-value technologies ahead, either before or in combination with external investment. For example, Neurexis Therapeutics, a VIC Technology Venture Development portfolio company, licensed innovation from a Colorado university, and—as a result—was qualified to apply for a grant from the State’s Advanced Industries program, resulting in a $250k match of our initial $500k seed investment. Although it may not sound like much, any research-focused money at the earliest stages of a start-up’s lifecycle can have a much-desired multiplier effect.

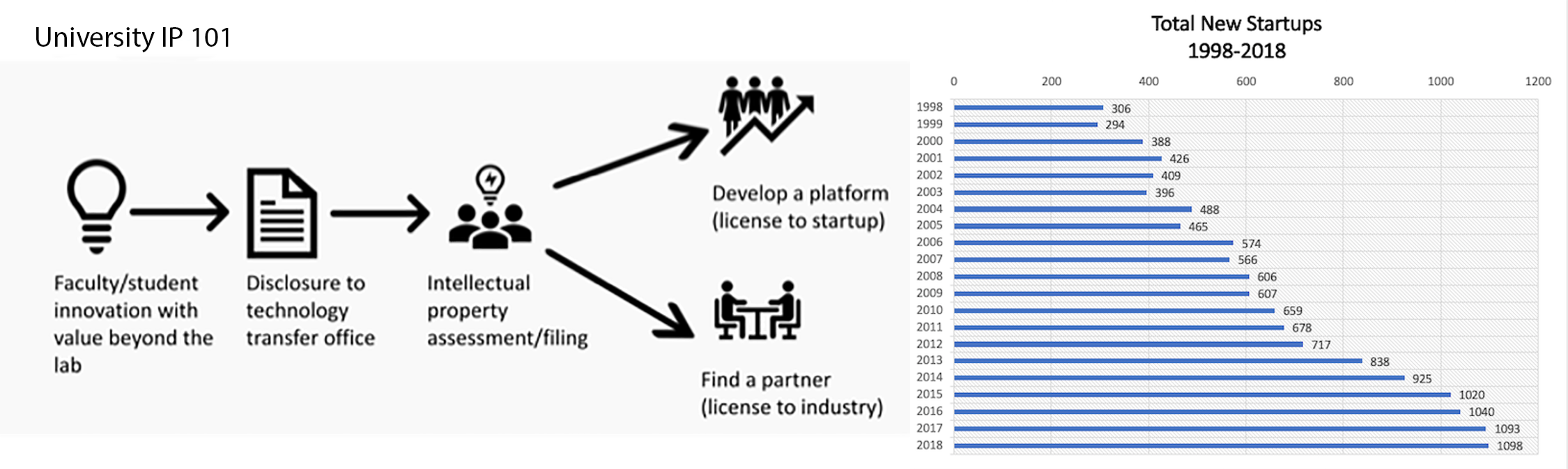

Now, let’s turn our attention to the perspective of the individual wanting to access innovation from the university, as an entrepreneur, an investor or a partner. The first hurdle is getting a response: I can’t tell you how many times I or my colleagues have reached out to a TTO requesting information on potential investment opportunities and never heard back from them. Even with the (hopefully) added credibility of being one of the few groups creating companies from scratch based on university innovation, we often struggle to get a reply after multiple attempts. The underlying problem is that most TTOs are not performance-driven. Yes, they typically publish annual reports on the standard AUTM metrics (number of invention disclosures, patent applications, issued patents, start-ups and patent-derived revenue), but no one’s job is on the line if they don’t deliver value to the customer. Who is the customer, you might ask? Internally, it’s the people on campus creating the innovation.

Externally, it’s an ecosystem that takes the invention to the next level. The solution: Hire people with real-world industry experience. By having individuals on the team that have gone through the process of accessing technologies from TTOs, you significantly improve the chances of success. In my own experience, working with like-minded individuals—i.e. let’s get to “yes” rather than a default stance of “no”—has invariably been more pleasant and productive than the alternative. I’ve also found that TTO employees who don’t have a track record of deal-making in the private sector tend to let their feelings jeopardize the negotiation process, and often lose sight of the big picture…giving the asset an opportunity to prove itself. Another fundamental advantage is that a commercially savvy TTO representative typically has more realistic expectations for the fair market value of the intellectual property they’re hoping to license rights to. They understand that—although important—the grant funding used to create the invention is a drop in the bucket relative to the amount of time and capital required to move it through early-, mid- and late-stage development. For FDA-regulated products, this can be 5+ years and tens of millions of dollars to reach a return on investment.

Don’t get me wrong – I’ve worked with some excellent TTOs and have featured interviews with many of them via the VIC Newsletter. I’ve also experienced brain damage interacting with others. My question to them is invariably, do you want to make a positive impact on the world, or (insert awkward pause) do you want your innovations to wither away on the proverbial vine? In reality, only a small fraction of these ideas (less than 1%?) make it to the next step and connecting them with the right resources is like finding a needle in a haystack, so take advantage of the opportunity when the stars align.

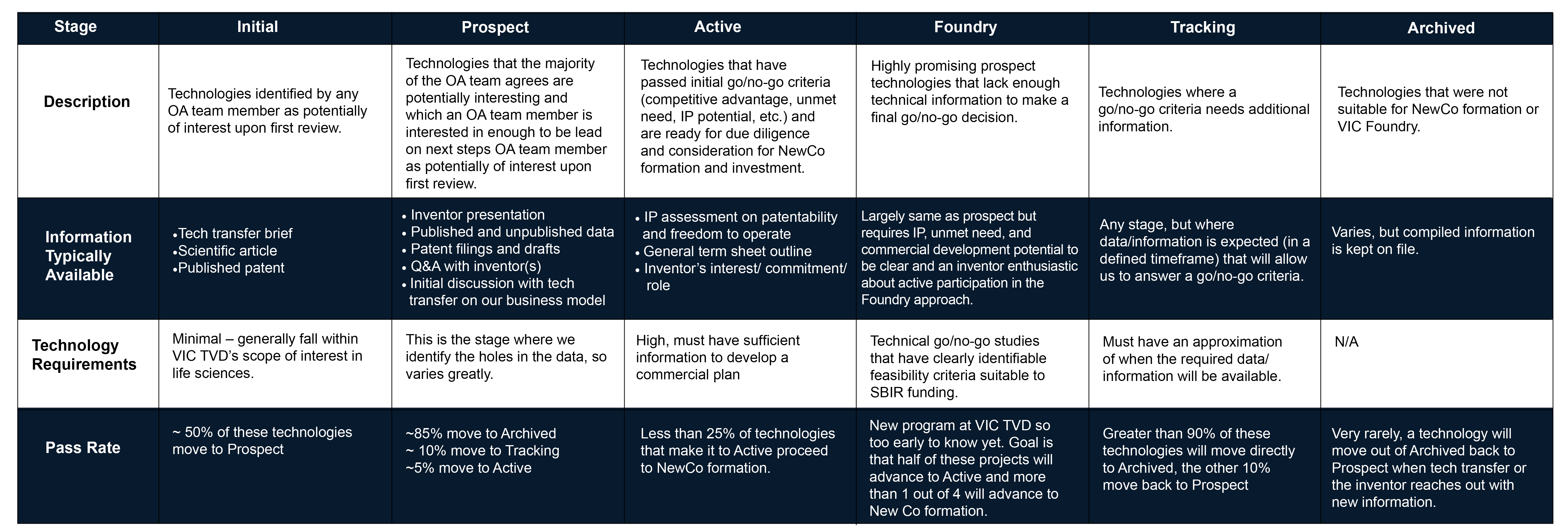

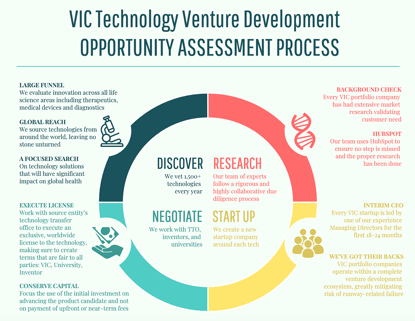

This brings me to the VIC model and how it adds value to the technology commercialization efforts at research-focused universities. As I mentioned previously and need to reemphasize here, we are one of the few investor groups willing to roll up our sleeves and look at innovation at these early stages. We pride ourselves on professional and courteous interactions with TTO staff and the inventors. Our due diligence process is well-designed and coordinated and involves not only VIC team members, but a much wider network of technical and medical experts. Whenever possible, we try to provide meaningful, and ideally, actionable feedback on the technologies that we decide not to move forward with. For those that we do pursue, we have the flexibility to either directly invest in a new company created specifically for a given asset, or—if we feel that there are underlying technical questions that need to be addressed—we can apply for SBIR and STTR funding through the VIC Foundry.

This brings me to the VIC model and how it adds value to the technology commercialization efforts at research-focused universities. As I mentioned previously and need to reemphasize here, we are one of the few investor groups willing to roll up our sleeves and look at innovation at these early stages. We pride ourselves on professional and courteous interactions with TTO staff and the inventors. Our due diligence process is well-designed and coordinated and involves not only VIC team members, but a much wider network of technical and medical experts. Whenever possible, we try to provide meaningful, and ideally, actionable feedback on the technologies that we decide not to move forward with. For those that we do pursue, we have the flexibility to either directly invest in a new company created specifically for a given asset, or—if we feel that there are underlying technical questions that need to be addressed—we can apply for SBIR and STTR funding through the VIC Foundry.

We are often asked by TTOs to become an extension of their entity, serving on the aforementioned external review committees or as judges for various funding programs, and will often do so time permitting. Last but not least, inventors—in addition to having an equity stake in the companies we form—may also serve as the part-time CSO/CMO/CTO while maintaining their university affiliation so long as there is no conflict of interest or commitment concerns. This all depends on the culture of the institution. In most cases, entrepreneurship and technology translation are wholeheartedly supported. Then there are the exceptions where campus innovators are treated like pariahs. Trust me…I’ve seen it all.