Angel investors often invest at the seed stage of a company's development. The typically smaller round sizes and lower valuations allow early individual investors to gain a meaningful stake in a given company. However, these investors also typically face the greatest risks including technology, product development, regulatory, and other significant challenges. Herein, we discuss some of the more significant of those additional risks and ways to mitigate them. With the higher ownership stake provided by the lower valuations and other potential advantages such as 100% exclusion from capital gains taxes (via IRS Code Section 1202, which will be the subject of a future article), the reward-to-risk ratio for early investors in high-impact, high-upside life science companies can be exceptionally attractive, provided the risks are both clearly understood and properly managed.

One major hazard faced by early investors is the possibility that later larger investors set investment terms that damage the upside for these initial investors who took the largest risk. It is critical that the company’s Board of Directors and management work hard to protect the interest of all stakeholders, certainly including the earliest investors. However, company management incentives can become misaligned with the protection of early-stage investors. For example, management might be more concerned about protecting their paycheck than protecting the early investors from damaging terms on future investment rounds. This can lead them to strongly recommend to the Board to accept investment terms from the first significant investor that they gained interest from. If they do not express strong confidence in being able to bring other investors forward that might invest on better terms, the Board may view the decision to go forward as the best option despite the negative impact on the early investors. Although the management team would typically also face dilution to their ownership positions (e.g., their stock options are diluted with the investment raise), the new investors are investing at least in part based on the management team and are likely to offer additional stock options to keep the management team incentivized.

The misalignment of management team motivations can occur even with good management teams with good intentions. Raising capital can be difficult for pre-revenue companies, even those with very high upside, and especially so in areas outside of the investment hot spots (i.e., geographic locations with substantial venture capital activity). It is important that the earliest investors protect themselves from damaging terms in future rounds to the degree possible while not unduly limiting the company’s ability to raise capital. This can be done in several ways. One way is to provide participation rights in future rounds so that an investor’s ownership stake can be protected. However, this approach only provides value when the earliest investors have the financial wherewithal to participate in a meaningful way in the later, larger rounds. A second approach is specifying in the original investment that the early round investors have to agree to “Major Decisions” including terms in new investment rounds preferential to their original investment terms. In combination with staying in close communication with management on new funding rounds, helping introduce them to new prospective investors, and making clear what type of terms are and are not acceptable in follow-on rounds, having veto power over poor term sheets can mitigate risk. Providing the management team with a clear understanding of which terms in a new investment round will, and will not, be acceptable to the earlier investors helps ensure that the term sheet negotiation with new investors does not get off-track.

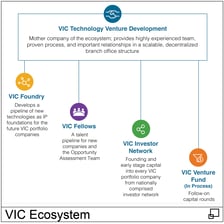

A third risk mitigation approach is to have an aligned investor who has substantial “voice” in the company that will protect all the earlier stage investor interests through a combination of shareholder voting rights, board participation, and ability and willingness to make bridge investments in case of company cash shortfalls, as well as offer alternatives in the case that the only deal on the table is a bad deal for the early investors. Of course, an aligned investor such as this is not always readily available. For VIC Investor Network (VIN) member investments, VIC Technology Venture Development serves this role. VIC Technology Venture Development is the mother company of the nationwide VIC innovation ecosystem and is a co-investor in every VIN round. This is a specific advantage for members of VIN compared to most angel investment networks.

A third risk mitigation approach is to have an aligned investor who has substantial “voice” in the company that will protect all the earlier stage investor interests through a combination of shareholder voting rights, board participation, and ability and willingness to make bridge investments in case of company cash shortfalls, as well as offer alternatives in the case that the only deal on the table is a bad deal for the early investors. Of course, an aligned investor such as this is not always readily available. For VIC Investor Network (VIN) member investments, VIC Technology Venture Development serves this role. VIC Technology Venture Development is the mother company of the nationwide VIC innovation ecosystem and is a co-investor in every VIN round. This is a specific advantage for members of VIN compared to most angel investment networks.

Let us look at some of the terms that need to be considered in any investment round from the lens of an early investor. Here are a few of the important term sheet considerations:

Valuation

Investing in a seed stage life science company always carries significant risk. To counter-balance this risk, when VIC and its affiliated VIC Investor Network place founding round investments of up to $500k in new companies being developed within the VIC innovation ecosystem, the investments are placed at low valuations. Specifically, these founding round investments are placed at less than $1m pre-money. Across the country, it is rare to see companies with large market opportunity, strong intellectual property position, and done-it-before management teams in place available to investors at sub-$1m valuations. However, we believe that the lower valuations are necessary in the company founding round to protect against the risk and also to keep larger, future capital rounds from being constrained by over-valued early rounds. A moderate initial round valuation allows for appropriate stepped-up valuations in subsequent rounds as the company and the overall risks are mitigated.

Liquidation Preference

For the founding capital rounds, we specify non-participating preferred liquidation preference (see Note 1 below for a description of non-participating versus participating preferred liquidation preferences). We believe that non-participating preferred provides better alignment of interests for all co-founders and investors compared to participating preferred. In our opinion, it is simply a fairer way to setup the liquidation preference. And, importantly, the potential additional upside provided by participating preferred is not needed if the company valuation is attractive as it always is for VIC/VIN investments. Setting non-participating preferred in the founding round also establishes a precedence for follow-on rounds. If the founding round was instead set as participating preferred, it’s assured that the later rounds will be participating preferred also. For the founding and early round investors, that actually could cause a lower return in some scenarios (e.g., see Note 2 below).

Board Participation

It is important that the early round investors have one or more board seats dedicated to them rather than simply relying on their shareholder voting rights to maintain a board seat. As follow-on, larger investment rounds are acquired, the early investors’ ownership percentage not surprisingly drops, and may not be considered enough to warrant a board seat by other stakeholders in the company if the right to have one has not been firmly established as a term in the early round. It is important for the early investors to build a rapport and mutual understanding with later round investors. Later round investors may not be as interested in considering the needs and input of the early round investors and the larger risk that they took if they do not have an ongoing relationship together.

Protective Provisions

Protective provisions can apply to a broad range of matters. They are important to consider in order to safeguard against certain company events and changes that might damage the prospects for financial returns to the investors. For example, it can be specified that any act which would adversely change the rights of the preferred investors, has to be approved by the preferred investors. This can include requiring consent for the creation of any other security having rights, preferences, or privileges senior to the current investors. VIC strives to have follow-on rounds that are pari passu (i.e., equal footing) with the earlier investor preferences. If exceptional circumstances occur, such as a significant regulatory setback, and warrant terms like a senior liquidation preference for later investors, then the earlier investors—voting together as a class of ownership—must specifically agree to this.

There are many other terms to consider in the protection of the early investors. It is difficult for an individual angel investor, or the typical angel investment group, to protect their investments from damaging terms on future rounds, especially if a company faces unexpected obstacles. Some of the ways to mitigate the risk of damaging terms in future rounds are described above. Of course, the best protection is to invest in companies that achieve great performance. For the type of life science companies that VIC forms, maximizing the opportunity requires deep front-end due diligence on the intellectual property, market size, market drivers, regulatory plan, and much more, along with putting in place experienced, “done-it-before” executive teams from day one into each new company. We have learned many lessons over the years (some the hard way) in how to approach the formation and development of high-impact, high-upside life science companies.

Note (1) – Participating versus non-participating preferred liquidation preferences:

In essence, upon liquidation of a company, a participating preferred stock provides the shareholder a preferential payment of their initial investment plus a percentage share of the remaining liquidation proceeds. Non-participating preferred liquidation preference also provides the shareholder a preferential payment of their initial investment. However, if the total liquidation amount is of sufficient amount such that on a pro-rata basis the non-participating shareholders would get at least their original investment back, then the distributions are simply made on a pro-rata basis.

That is a simplified description. For a more complete description of participating vs non-participating liquidation preference see, e.g., What is the Difference Between Non-Participating and Participating Preferred Stock?

Note (2) – Example of how participating-preferred can lead to lower return for earliest investors compared to non-participating preferred liquidation preference:

NewCo, Inc. is founded with a $250k capital investment at a $500k pre-money valuation. The founding investors, therefore, own 33.3% preferred shares in NewCo ($250k/$750k post-money).

A second investment round of $5m at $5m pre-money dilutes the founding investors by 50%, i.e., the founding investors own 16.7% preferred shares in NewCo following the second investment round.

For this simplified example, there are only those two investment rounds (i.e., the founding round and the later round and NewCo is sold for $15m at some point following the later round).

In the case that all investors have a non-participating preferred liquidation preference, and no other financial preferences, then the founding investors in NewCo would receive 16.7% of the $15m sales price, which is $2.5m.

In the case that all investors have a participating preferred liquidation preference, and no other financial preferences, then the founding investors in NewCo would receive their original investment of $250k, the later round investors would receive their original investment of $5m, and then each would receive their percentage interest in the balance of the $15m sales price (i.e., $9.75m). Thus, the founding investors would receive $250k plus 16.7% of $9.75m which works out to a total of $1.9m.

In this scenario, the founding investors get a significantly lower return ($1.9m) for participating preferred, than they would get for non-participating preferred ($2.5m). Conversely, the larger, later round investors get a significantly higher return in the case all investors being participating preferred.